The Good, the Bad and the Ugly in Cybersecurity – Week 7

February 12, 2021

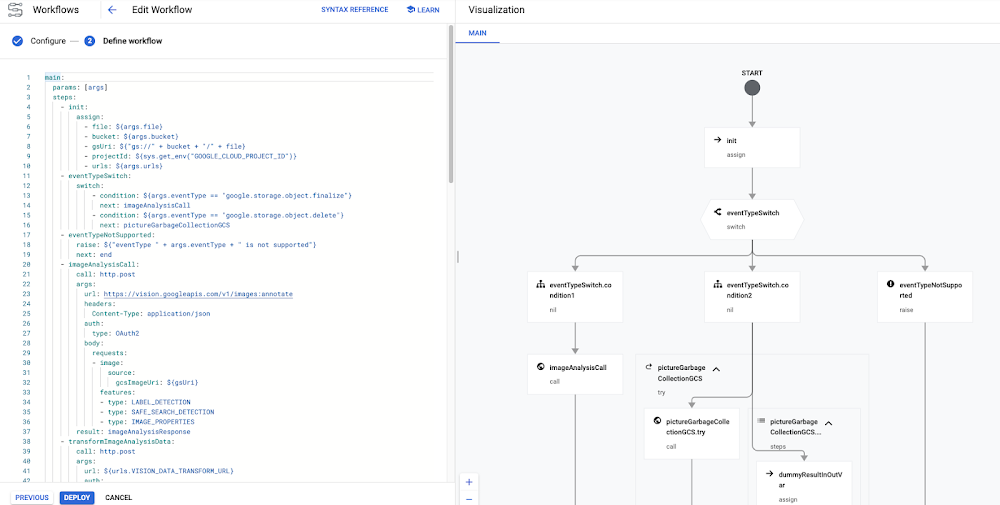

Orchestrating the Pic-a-Daily serverless app with Workflows

February 12, 2021Zirtue–a fair and equitable lending option

Zirtue is a relationship-based lending application that simplifies loans between friends, family, and trusted relationships with automatic ACH (automated clearing house) loan payments. Everything is done through our app: the lender sets their payment terms, receives a loan request from a friend or family member, the borrower gets the funds, and the lender is able to easily track payments. The app also handles reminding the borrower to stick to the agreed upon terms and gets you paid back–avoiding that awkward follow-up call or text.

Currently, both parties must have a bank account to set up a Zirtue account. However, approximately 25% of our target market is unbanked or underbanked and thus, ineligible for a loan. So we’re proud to be launching a Zirtue banking card this summer, to empower customers to link their transactions to our card instead of a bank. Funds will automatically load onto the card, and can be used to direct deposit paychecks, as well as a form of payment for goods and services. Using the card will help users graduate to other banking products in the future. Good Zirtue performance metrics can function as an alternate credit history, giving banks the data they need to confidently provide additional services and ultimately help break the cycle of predatory lending. Our recent infusion of $250K in funding from Morgan Stanley, as part of the Rise of the Rest Pitch Competition, and $250K from the Revolution Fund will help us achieve this major goal.

Google Cloud technology for the greater good – Building Trust & Security

Financial transactions happen almost entirely online these days, so Zirtue relies on Google Cloud technology, including reCAPTCHA to make our app work day in and day out. Since we are handling sensitive financial information, security is top of mind. We are very proactive when it comes to protecting the integrity of the application and user data, including the use of bank-level encryption (AES-256), tokenization, hashing (SHA-512) and Two-Factor Authentication throughout the application. Further Google Cloud helps with security by encrypting data at rest and in transit.

Our customers rely on us to send and receive money quickly, so it is vital to keep interruptions in service to a minimum. Firebase Crashlytics provides us with realtime crash reports that allow us to quickly troubleshoot problems within our app. Currently, we are growing 45% month over month, so there is no shortage of data to train and build out our AI/ML models. We are utilizing Cloud AutoML, which has the ability to train our ML models with a wealth of data from Zirtue borrowers using video to fill out their loan applications. The speech to text API transcribes the videos that are used to train our ML models to provide a more seamless user experience. This will also be used as an accessibility feature through the translation API, allowing customers to speak in their preferred language throughout the application process.